Whether you’re working on creating a budget or you are trying to simplify the bookkeeping for a small business, tracking your expenses should be a first step. If most of your spending is done electronically (using a debit card or a credit card), you may be able to get away with just tracking your cash spending. Most money management software can automatically import those electronic expenses, further simplifying matters. You can also choose to use your own system, from the ground up, including setting up a spreadsheet and entering information by hand.

Getting In The Habit of Tracking

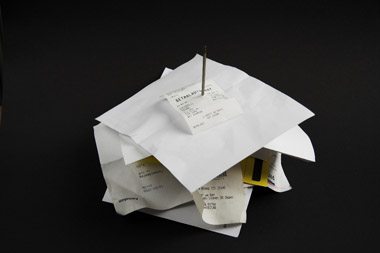

When it comes to tracking expenses, you can make your system as simple as collecting receipts and organizing them once a month. You might get a little more information from other expense tracking systems (listing them in a spreadsheet, using money management software or even choosing an online application), but all methods have one thing in common: you have to get in the habit of thinking about your expenses. It’s very easy to misplace a receipt or forget about any cash you spent. You may even think that a cup of coffee or a trip to the vending machine isn’t worth tracking — although those little expenses can add up amazingly fast. There are all sorts of opportunities to throw a kink into your plan to track expenses. You have to get in the habit of doing so, to reduce those lapses, and make sure that the data you’re basing financial decisions on is solid.

It’s also worthwhile to track your income in the same system that you track your expenses. This may seem like a no-brainer, because many people think that they only have one source of income: the salary that they receive from their job. In truth, however, most of us have additional sources of money, whether we hold a yearly garage sale, freelance or receive rebates. If you choose an application specifically created to track expenses, you’ll find that most have some sort of tool for inputting information about your income as well. If you decide to use a system of your own devising, such as a list of expenses in a spreadsheet, you’ll need to clearly separate income and expenses — place them in different columns, make one negative or denote the difference in another way.

Using Your Information

Once you’ve built up a lot of information about your expenses, you can use it to make a number of different financial decisions. You can easily broadcast your future spending — and plan out a budget. If you aren’t comfortable with the amount of spending you’re doing, you can also use all those expenses you’ve been tracking to help you set limits and finding places where you can reduce your spending. If, for instance, you notice a lot of lunches out, you could cut those expenses by committing to brown-bagging on a more regular basis. As long as you already have information on your expenses in hand, you can use it to make a long list of decisions much easier.

A Few Online Options

While you could use a notebook or a spreadsheet to track your expenses, there are more than a few tools online that are able to handle all the details — and may have a few additional features thrown in:

- Xpenser: If you’re always on the go, Xpenser can be a good option. It allows you to text your expenses in, helping you ensure that you don’t forget to track your spending between the store and home. In addition to SMS, you can email, Twitter, IM, call or manually add your expenses.

- Moneytrackin’: For tracking expenses in multiple accounts — such as business and personal — Moneytrackin’ provides easy management of expenses between those accounts. You can also tag transactions and budget easily.

- Mint: While Mint only tracks your expenses made through a bank account (checks, debit cards, credit cards), it does integrate expense tracking with a whole host of other features, including tools to help you analyze your spending and automatic expense categorization.

- Buxfer: Another site that primarily tracks expenses made through bank accounts, Buxfer also has tools to help organize shared expenses — such as splitting the rent with a roommate.

- Shoeboxed: You can add expenses by hand to Shoeboxed, but the site’s real value is that (for a price) they’ll scan in your receipts and upload them to your account on the site. If you do a lot of spending with cash, this site can truly simplify matters.

No matter which option you decide to go with, I do think it’s worthwhile to pick a system that is as automatic as possible — writing down everything by hand and entering it into some sort of money management program just seems like a fast way to use up a lot of time. If you use another tool besides those listed above and really like it, please share it in the comments.